I feel tremendous sympathy for this author for the thousands of hours he must have spent poring over the tax code, looking for inconsistencies, fictions, falsehoods and other legal avenues to avoid paying taxes--none of which ever mattered from the practical standpoint of the IRS's real-world enforcement powers. His entire quest, in this book and in his others, is quixotic and pointless.

Thus you'd be a fool or insane to follow any of the specific steps or advice in this book. At best, you'll be laughed out of your company's HR office; at worst you'll be thrown in jail. Don't do it.

When you're inside a Kafka novel it doesn't matter how logical you are.

[A quick affiliate link to Amazon for those readers who would like to support my work here: if you purchase your Amazon products via any affiliate link from this site, or from my sister site Casual Kitchen, I will receive a small affiliate commission at no extra cost to you. Thank you!]

However, this book contains insights, but you'll need to avoid the author's wrong-headed first-order conclusions and move on to second-order thinking. As such, the author indirectly shows perceptive readers certain features of late-stage American monoparty pseudo-democracy, most of which I really wish weren't true:

* The US government frequently does things that are unconstitutional and extralegal.

* If necessary it will use the court system to codify this activity, or else use its own regulatory bodies to formalize it via administrative regulations and/or enforcement actions.[1]

* Once it codifies the activity, it will form a bureaucracy and a political constituency around it to entrench it into institutionalized permanence.

Once you get to the institutionalized stage, you cannot kill it, and the extralegality or unconsitutionality of it stops being relevant at all. Therefore, stamping your foot about Social Security's unconstitutionality, as this author does relentlessly, is a futile exercise.

"How long will we allow this madness to continue?" he asks with anguish, as he cites some lie our government told us, or points to some paragraph in the Internal Revenue Code that makes no sense. Again, I sympathize. But the madness will continue for as long as it continues.

Any possible "escape" from this system--or from Social Security taxes at least--means escaping from W-2 income in the first place, by saving and accumulating as much of your own capital as you can, and thus gradually and relentlessly reducing your dependency on W-2 salary labor. The path for this has been well-mapped in books like Your Money or Your Life, Early Retirement Extreme, Choose FI, and many other books in the FIRE domain.

It is not by sharing a delusional argument that because the IRS's or Social Security's rules are unconstitutional (or illogical, or circularly defined, or unfounded, or whatever), you therefore don't have to follow them. You can make all the arguments you want based on things you think are wrong, but the court system will still put you in jail if you don't pay your taxes.[2]

Footnotes:

[1] See the US Securities and Exchange Commission for a long history of blatant examples of "regulation by enforcement actions," especially recently under former Commissioner Gary Gensler.

[2] As it did to this author as a matter of fact.

PS: When I read books like these I use a 20 Zimbabwe dollar bill as a bookmark. It's to remind me of what all governments (including my own) eventually do, some gradually, some suddenly: debase the money to meet obligations it cannot pay.

[Dear readers: what follows are my notes, quotes and reactions to the text. They are meant to organize my thinking and help me remember--and they are not worth reading. Don't even bother to skim the bold parts.]

Notes:

Introduction:

11ff On Social Security as a Ponzi scheme no different from that devised by Ponzi himself, except that Social Security is much, much bigger and implemented by force.

Chapter 1: Socialism Arrives in America

15-16 "The government has consistently misrepresented every aspect of Social Security to the public so Americans have absolutely no conception of an item in the federal budget that accounts for 30% of the government's expenditures... Without the help of a fraudulent judiciary the government could never have foisted such an illegal program on the public."

18 Interesting point made here in a footnote: lawyers are officers of the Court, thus they are automatically a part of the judicial branch of government; but regular people can't serve in the judicial branch of the government without first becoming a licensed lawyer, while lawyers can serve in any of the three branches of government; thus lawyers as a group constitute a form of "nobility" who can serve in all three branches while everyone else can serve in only two branches of the government.

20 "So let's cut through all the nonsense, find out what Social Security really is, and discover how anyone can drop out."

Chapter 2: Surprise! Social Security--Just Another "Income" Tax

23ff On the Social Security tax rate of 5.4% plus the Medicare tax rate of 1.3% [note that this was in the 1980s and these rates are higher today: you and your employer split a 15% tax rate for Social Security all W-2 income. Note also the tax rate originally was just 2% back in the very early days of the program.] On various falsehoods and misleading elements of the Internal Revenue Code dealing with Social Security and Medicare, the fact that these are a second income tax, and the author thinks that the government can't make American subject to two income taxes [sadly, in 2012, the author (who died in 2015) had the ironic misfortune to Obamacare, passed in 2010, deemed a "tax" by the Supreme Court in 2012, making it three separate income taxes!] [It's also worth noting that while the author might be technically correct stating where the Internal Revenue Code misleads or makes inaccurate statements, it doesn't matter that it calls something by some other name: this does not give a citizen a legal avenue to escape the tax system just because he claims there are inaccuracies or falsehoods in the Code.]

27 The author tries to distinguish between wages and income, claiming that Social Security is a tax on income, not on wages.

29ff On claiming you're not liable for taxes unless they're already "assessed" by the office of the secretary. Also quibbles on the definition of "income" which the internal revenue code defines using the word income, which aesthetically bothers the author: "...(as any eighth grader should know) a word cannot be defined by using the word itself in the definition!" [Once again none of these legal distinctions or technicalities matters: it doesn't matter that they are inaesthetic, bothersome, inaccurate, etc. Plenty of people have been put in jail trying to not pay taxes based on technicalities like these, including--as it turns out--the author himself.]

35 "But, if 'income' is nowhere defined in the Internal Revenue Code, how can 'income' be logically or legally taxed? Can the law tax something that the law does not define?" [Once again, this is the kind of legal "logic" that will get you thrown in jail for many years.]

Chapter 3: How to Stop Employers from Withholding "Social Security" Taxes

39ff The author provides an affidavit here that you can give your employer to stop it "from deducting an undefined and unassessed 'income' tax from your wages." [Again, this is the kind of thing that will get you thrown into jail]. More claims here how this section of the Internal Revenue Code is based on fraud.

Chapter 4: Employers and Self-Employeds--How They, Too, Can Drop Out

47ff Repeating the assertions that Section 3101 taxes are "income taxes" that are thus illegally levied, while the Section 3111 taxes paid by the employer are also illegal and unconstitutional, because they are called "excise taxes" when excise taxes are only levied on things like cigarettes or a gallon of gas. "Its use here merely signals the government's attempt to jimmy an unauthorized tax into Article 1 of the Constitution." [Again, while the author thinks this is an argument, in reality--in the context of what the IRS can do to us as citizens--it is not an argument.] Various other useless and legalistic arguments here on grounds for not paying income tax: that it's contrary to the Constitution, that the law "technically" does not require the tax be paid; that the concept of "self-employment income" is nowhere to be found in the tax code, that the term self-employment income is not properly defined, etc. [Once again it does not follow that because there are inconsistencies or illogical things in the legal code or the tax code you therefore don't owe any taxes! Already, this early in the book, I feel tremendous sympathy, even pity, for the author. Imagine the thousands of hours he must have spent pouring over the tax code looking for legal avenues, inconsistencies, fictions, falsehoods, none of which matter from the practical standpoint of the IRS's enforcement ability to make him, or you, or me, pay taxes.]

54 On the fact that Social Security was extended to self-employed individuals, not in the original act, but that this was added in 1954.

63 Striking and disturbing that at the end of this chapter the author suggests self-employed individuals simply "stop filing quarterly and annual tax returns altogether" a preposterous and highly dangerous course of action.

Chapter 5: The Supreme Court--Playing Games with the Law

67ff "On April 14th, 1937, the Court of Appeals for the First Circuit in Boston, Massachusetts declared the Social Security Act unconstitutional on a variety of grounds." The author walks through the various legal arguments here [none of which are really relevant to a modern reader navigating today's legal environment. Remember Obamacare insurance mandate was "unconstitutional" until it was redefined by the Supreme Court as a "tax"]. For example, one can observe the fact that a tax is not consistent with the general welfare clause of the Constitution, but this has nothing to do with whether the nation state will impose a such tax (and also enforce it). We can see the pointlessness here author's own words: "Of course, the government today now violates this provision with total impunity and does not feel bound by it in any manner, shape or form, thanks in large measure to its success in getting Social Security through the courts." [Murray Rothbard was absolutely right in his Anatomy of the State when he wrote that the court system is an instrument of state power, and will typically tends to expand the state's power using the mechanisms of common law and legal precedent.] [Also: if the author knows that the government "violates this (general welfare) provision with total impunity" then why does he cite "inconsistency with the general welfare clause" as a reason when the "reason" self-evidently doesn't exist anymore? This is where you wonder if the author is a little bit delusional, grasping at truths that are no longer true...]

78ff True to Rothbard's dictum above, the Supreme Court bent and twisted the law and found a way to reverse the lower court's decision.

80ff On how the Social Security plan and its withholding mechanism forces private citizens into government service as unpaid agents and/or stakeholders; the author cites this as a violation of the 13th Amendment on involuntary servitude. [Again, nobody cares. No one is going to re-litigate the existence of the lawfulness of Social Security, it exists.]

85 Discussion here about how this was originally "old age insurance" but then later when defended in the court system, the government contended to the court that Social Security was a tax, not insurance. [Once again this sounds very familiar for those who followed Obamacare through the court system and watched it evolve from "the government forcing citizens to buy an insurance product" into a totally different species: it was ultimately deemed a tax, not insurance.] "Since the Court obviously wanted to hold the Act constitutional, it contrived arguments to enable it to do so." The author then goes through Justice Cordoza's argument, poking a zillion holes in it, and arguing that despite his "vaunted reputation" he had no real understanding of the taxing clauses of the Constitution, no understanding of the Social Security law he was attempting to judge, nor any understanding of the equal protection clause of the Constitution.

94ff On how the Court essentially ignored the question of the fact that Social Security tax money is not earmarked; the court basically wrote decided to "leave the question open" and didn't address it at all. The author shouts in all caps here: "CAN YOU BELIEVE IT!?" and then goes on to argue that this specific issue was the most important one of all, and the court couldn't address it at all without finding the Social Security Act unconstitutional; thus the mechanism here was to duck the problematic issue entirely, despite the fact that the lower Court of Appeals cited this specific issue as why the act was unconstitutional in the first place. [Depressing but also fascinating to see this mechanism in action: you can still codify something that was found definitionally unconstitutional.]

Chapter 6: How Social Security Was Sold to the Public--Would They Buy it Today?

99 "The Federal government sold Social Security to the nation on a basis that is entirely different from how it operates that program today." [At this point in history one simply has to accept that things like this are a feature, not a bug, of modern pseudo-democracy.]

100 Quoting a New York Times editorial from 1935 which criticized the Social Security program on many levels, including the fact that the reserves acquired by the program would be usurped by politicians for other purposes. [Nowadays, it's hard to believe that there was once a time when the New York Times was not a regime-compliant media outlet.]

104-5 On how the program was sold to the American public as an actuarially-funded insurance plan, not as an unfunded pay-as-you-go Ponzi type scheme as it actually is.

106 "How long will we allow this madness to continue?" [I really feel for this author, but again, what is the point of screaming into the abyss?]

Chapter 7: An Analysis of government Studies: Proof that Government Cannot Be Trusted

109ff On the 1981 National Committee on Social Security Reform, established by President Reagan, and its 1983 report on how to save the program--and the author's appalled realization that the government plan to "save" the system simply added still more claims on still more citizen income, and that this simply postponed the program's inevitable reckoning. [This reminds me of the joke about the two complaining Jewish ladies in the Catskills: "The food here is terrible!" "Yes, and such small portions!"] Charts and graphs here on the parabolic increase in expenditures for the program, the declining number of workers relative to the number of Social Security recipients, etc. [Some cynical realtalk here: It's worth noting that the author never talks at all about how inflation can used to help the system limp along, as benefits are increased with "CPI inflation" measures but still at levels below actual/true inflation; also he couldn't know about what turned out to be decades of mass immigration into the USA that may make the program somewhat less unsustainable than it otherwise would be. Note, however, that now we've built systems that depend on constant mass immigration and constant inflation, this creates a whole different set of problems for our society.]

131ff Interesting comments here from testimony for the Joint Economics Committee of W. Allen Wallis, Chancellor of the University of Rochester and chairman of the 1975 Advisory Council on Social Security: Wallace talks about how most people think that their Social Security taxes are "taken out" of their wages and then "contributed" to their own Social Security benefits when in reality it's a pay-as-you-go system paying that money directly to those who are already retired; Wallis then says "Once you understand this, you see that whether you will get the benefits you are counting on when you retire depends on whether Congress will levy enough taxes, borrow enough, or print enough money, and whether it will authorize the level of benefits you are counting on. The situation is in no way analogous to putting money each month into a private insurance company which invests it and undertakes to pay you an annuity. Misunderstanding of the pay-as-you-go nature of Social Security is widespread among journalists and the public. Indeed, this misunderstanding seems to have been deliberately cultivated sometimes, in the belief that it makes the Social Security system more palatable to the public." [One shudders to imagine what would happen in terms of societal rage if Millennials and Zoomers woke up and realized that they were making payments, taken from their paychecks, directly to support the wealthy Boomers they so despise!]

[A few other random thoughts: it's interesting also to think about the options of funding a Social Security plan with money that's actually invested--like a pension. Of course then almost all of it would be put into Treasuries, rather than being directly transferred to retiree beneficiaries. But in either case, the system is still predicated on the creditworthiness of the United States (some of the commentary in this book talks about this problem), and so you can make the argument that the "pension-like system with real money" is no better or worse than the pay-as-you-go scenario. Second, it's maybe worth thinking about the "velocity of money" component of Social Security: if you take money from workers and that money directly goes into the pockets of retirees, it's going to either be spent on home healthcare aides, boxes or Ensure and Depends or whatever, or stored in the banking system and fractionally reserved into the money supply, etc., but in a very real sense that money is recycled right back into the economy, paying wages to people and, ironically, getting taxed over and over again! I guess as long as you have enough (domestic or imported) workers for the system to limp along, this thing could theoretically last longer than people expect.]

140ff More criticisms of this committee's conclusions: saying that it's "current cost funded" when it really wasn't funded on any basis whatsoever; comments that exposed some of the misleading things said about the program when it was created. The author also makes a valid point here about the idea of a government agency holding government debt and considering that an "asset" when in reality they're all funded by and responsible for paying the same government debt, how can it then really be an asset? See for example the FDIC which holds US treasuries to insure bank deposits.

153ff The hearings addressed how the tax rate needs to be set at a level such that the voters continue to support Social Security as a program--not too high to eliminate support but not too low to make the system truly tenuous--and then next a discussion of how the US would never repudiate the implied Social Security obligation: it would pay for it with money that the government can print. Thus inflation/debasement would be used: it was known even back then that inflation would be used to surreptitiously tax the system in order to "technically" meet these obligations. [Then of course Modern Monetary Theory grew up around these realities to help justify it, or worse, create a new economic orthodoxy to explain it away.]

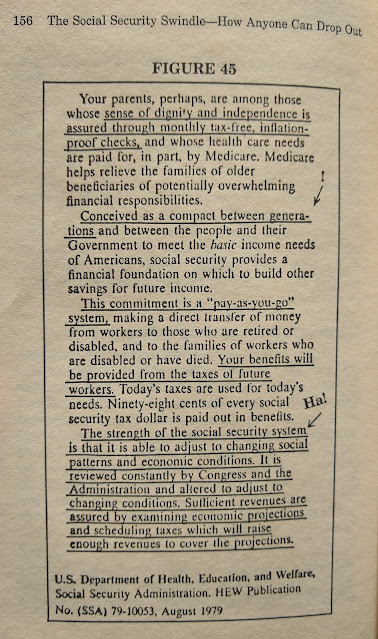

155ff On a 1979 pamphlet from the Social Security Administration that described Social Security as a "compact between generations," [see the photo below] which the author calls "a bold-faced lie." Rhetorically, however, this claim browbeat young people into believing they have some sort of "obligation to their elders"--based on promises made 47 years earlier by "vote-seeking politicians" who created a program that was never originally framed that way at all. Back then contributors into the system believed that their benefits would come out of their own contributions. [An exercise of analyzing good rhetoric but bad logic here: the author basically quote-mines various figures across the decades, ranging from Supreme Court justices to Congressional committee members for the apparently contradictory things they said about Social Security over the years and then cites these contradictions as evidence that "the government is lying to you." There's a problem here, however: many people will have understandably different impressions of something, some will have an agenda to reframe or renarrate what that thing is, and everybody has an agenda to keep this program alive, especially when it's teetering into insolvency. Thus it is like shooting fish in a barrel to find a few contradictory statements across time, across the millions of bureaucrats working for these agencies, and you could do this with every government program ever created probably. Further, none of this changes the fact that Social Security exists, it is codified in the law, and you can't kill it thanks to the piled up weight of history behind the program. The author, for all his effective rhetoric, is pointlessly shoveling sand against the tide. I think the book Perpetual Traveler has a far better navigational strategy for problems like this: leave the system, don't try to fight it.]

Chapter 8: On Taxes and Trust Funds

163ff On the fact that the courts believed the Social Security system was constitutional based on its belief that an actuarially sound reserve was to be created in order to pay the benefits, using accepted terms like premiums, reserves, tables of mortality, etc. Basically the court was relying on illusions created by the law and the propaganda surrounding the program in presuming there would be a financial reserve. Now our government openly admits that there's no such thing as this reserve, everyone knows that it's pay as you go. Also the author rehashes the government can always print money to meet its Social Security and other unfunded obligations: the author continues to argue that the government does this money printing illegally--in yet another windmill he's tilting at: "These worthless paper 'dollars' ...are not authorized to circulate as money by the U.S. Constitution. In fact, the writers of the Constitution included specific provisions to bar such criminal practices by both federal and state governments." [Once again, yes, they did, but it no longer matters: reality is as it is.]

Chapter 9: The System Encourages Rampant Abuse

173 "In this treatise no attempt has been made to analyze the alleged benefits of Social Security or to attempt to show how similar benefits might be purchased cheaper through private insurance carriers since such considerations are, in my view, immaterial. If the Act is illegal (which it is), no other consideration is important. This book was designed to help people get out of the program and to provide them with the legal, moral and economic means to do so." [By this definition the book and the author have failed, his solution will get you laughed out of your company's HR office, or worse, fired--or worst of all, thrown in jail. The author is complaining about illegalities and immoralities committed by a government that has no compunction at doing these things.]

173ff The author describes serious unethical elements of this program and questions the "superior moral attitude" as he phrases it for those who defend the system, when in reality the program itself is immoral. He first addresses the question "Should individuals who do not want or need Social Security benefits be compelled to purchase them?" [Recall that this was the exact same fundamental ethical question about Obamacare, as the program forced citizens to purchase health insurance; likewise, the program was presented in ways that were totally divorced from the actual reality ("If you like your doctor you can keep your doctor!"), and also resulted in tremendous inflation in healthcare premiums in the years that followed as the insurance industry, a natural oligopoly, extracted its rake off the system. The similarities are striking, the arguments that it's extralegal or unconstitutional do not matter any more, and likely it's best to get through your five stages of Kubler-Roth grief as soon as you can so you can really see the contours of the system and thus navigate it as best you can.]

175ff Disputing the rhetoric behind the argument that "people won't save anyway so the government has to force them to save": the author answers this by saying the plan actually prevents people from saving by taking their money and directly paying it to retirees, and worse of all it isn't saving in the first place since it's a pay-as-you-go system--there's no fund or investment whatsoever. "In reality, not one penny of Social Security taxes was ever saved for anybody..." Other arguments here: the "foreign freeloaders" argument: that people from other countries that would come to the US and work for a period of time to qualify for benefits (the author reminds us that Social Security benefits are weighted in favor of those who qualify for minimum benefits), then go back to their country and collect Social Security and live well by their home country's standards.

180ff Extended off topic discussion on unemployment insurance and how it's gamed by people.

186ff On the demographic problems of Social Security, including the fact that people are living longer. [Not any more they're not! Back in 1984 when the author wrote his book, this issue presented serious problems to Social Security's sustainability, but lately our country has, uh, done certain things to "help" make sure life expectancy is shorter today than it was in the 1980s.]

Chapter 10: Why Dropping Out of Social Security Is in the National Interest

192 The author expresses his amazement that supposedly free Americans passively turn over so much of their productivity to their government. Also an interesting section here where the author argues that big business serves government and in general managements of major companies are complicit in massive government wage taxation, withholding, and other things like this, and as a result they're sort of instruments of federal policy. [This is an extremely interesting insight in light of what happened during the COVID pandemic, where the government used OSHA regulations to indirectly enforce experimental COVID vaccine mandates through corporations. It's also interesting to see how COVID shutdown policies caused the closure of many small businesses to the enormous benefit of large businesses with big balance sheets. It is interesting to see so many different instances where regulation or government policy automatically favors the largest companies (because they have the balance sheets to survive more injury) at the expense of the smaller companies. Once again it looks very "neo-feudal."]

197ff Further discussion of the 1983-era deficits of $200 billion, which the author will shortly call "a ticking time bomb," [but which appear risibly small from the standpoint of a modern reader staring queasily at annual deficits sitting the trillions now and total debt sitting at $36 trillion. It really does make you wonder: do seemingly large deficits actually matter? People back in the 1980s all thought deficits "mattered" but yet they sure didn't seem to matter at all when they were a tenth the size they are now... so do we really know whether or not today's deficits matter? Will we look back forty years from now and laugh at how risibly small our deficits today actually were compared to far huger numbers in the future?] Comments further afield from the author here on ag subsidies on federal policy to pay farmers not to produce, on the inefficiencies this produces; discussion on how most government expenditures are either illegal or unnecessary; various examples of government waste [these are the usual, predictable pseudo-conservative arguments and talking points, anyone familiar with the ideology will already know what the author is going to say on all these topics.]

205 Unintentionally prescient comments here: "It must be recognized that America's military potential rests on its industrial base. Anything that undermines and weakens that base weakens America's military strength." [Note that laissez-faire free international trade is what hollowed out the industrial base of the United States--effectively exporting it to China. This is those awful ironies where an ideology thinks it's doing the right thing, but in reality it actually causes the such awful unintended second- and third-order effects that it puts the USA into existential risk! Worse, all the architects of free global trade are all dead or dying now, so they never had to suffer any of the downsides of their unintendedly bad architecture. The sins of the fathers are visited upon the sons.]

207-8 A strikingly incontinent argument here where the author cites how well-dressed people were at the New York world's fair in 1939, and he cites this as proof that we didn't need Social Security. And odd and incontinent way to end the last chapter of your book.

Appendix A

[Appendices A and B contain excerpts from the author's book The Biggest Con]

209 "Leaving the government's currency flim-flam and fleecing by inflation..." [Gotta respect the alliteration and assonance here.]

209ff Basically this is repetition of previous arguments of the book: that there's no monetary reserves behind Social Security, that the taxes are just spent like any other tax by the government, that there's no "trust fund," that it's not an insurance program, that all of the government information pamphlets about the program include profound mistruths and misinformation; repeat discussion on what is insurance and whether Social Security is actually insurance (it is not); why government bonds held in so-called government trust funds are worthless, since you can't write an IOU to yourself and call that an asset but somehow the US government can write an IOU from one department to another and call that an asset [again, this is repetition from earlier in the book]. "Insurance companies do not indiscriminately spend their premium income on projects and then leave their own IOUs (bonds) in the company till. If they did, they would be shut down and their officers carted off to jail."

Appendix B

233ff "In the final analysis it boils down to this: Is the nation's current generation of producers (especially those in their twenties), who are themselves struggling with families and careers, liable for the unrealistic economic promises of past generations of irresponsible politicians? Did politicians long-gone have the right to indenture unborn generations of Americans to the service of other Americans, simply to make good on their irresponsible campaign promises?" The author than offers his solutions for the problem, all of which should look familiar to most modern readers: needs testing, a gradual wind-down of the program; the former is something possible but the later remains as politically impossible as it always has been. Also on the government's use of inflation to impoverish everyone in order to make these types of pay-as-you-go programs limp along.

Appendix C

239ff This contains a form letter that a [delusional] employee could [but shouldn't!] write to his employer to instruct it to stop withholding Social Security taxes; also included here is a standard State Court complaint form suing for money damages for withheld Social Security taxes. [Don't do it!]

Appendix D

243ff The author gives examples of two different experts: Paul Samuelson the economics textbook author and Sylvia Porter the newspaper syndicated columnist, both of whom wrote about Social Security; "Probably no one has done more to scramble the brains of American youth and the subject of economics and MIT's Professor Paul A. Samuelson." [I totally agree, his textbook marginalized Austrian economics, blindly accepts orthodox Keynesianism, etc. I'd argue that the author's arguments could have been structured much more powerfully, his criticisms here are much weaker than they could be.]

245ff Addressing Sylvia Porter's four-part series on Social Security and her syndicated newspaper column in 1976. Interesting how she writes "millions of you simply would not set aside money regularly" [which in itself is condescending enough], but also it implies that the Social Security program actually would set aside money which it doesn't and never did. [You have to recognize how skillful this rhetoric is though, and let's face it, it works. Plenty of people still believe there's a Social Security Trust Fund!]

Finally, at the end of the book the author also offers a list of his other books, with this amusing quote: "Prices are denoted by [a zero with a slash through it] which refers to Federal Reserve units--fiat currency now fraudulently circulating as U.S. dollars." Shoveling sand against the tide.

To Read:

Irwin Schiff: The Kingdom of Moltz